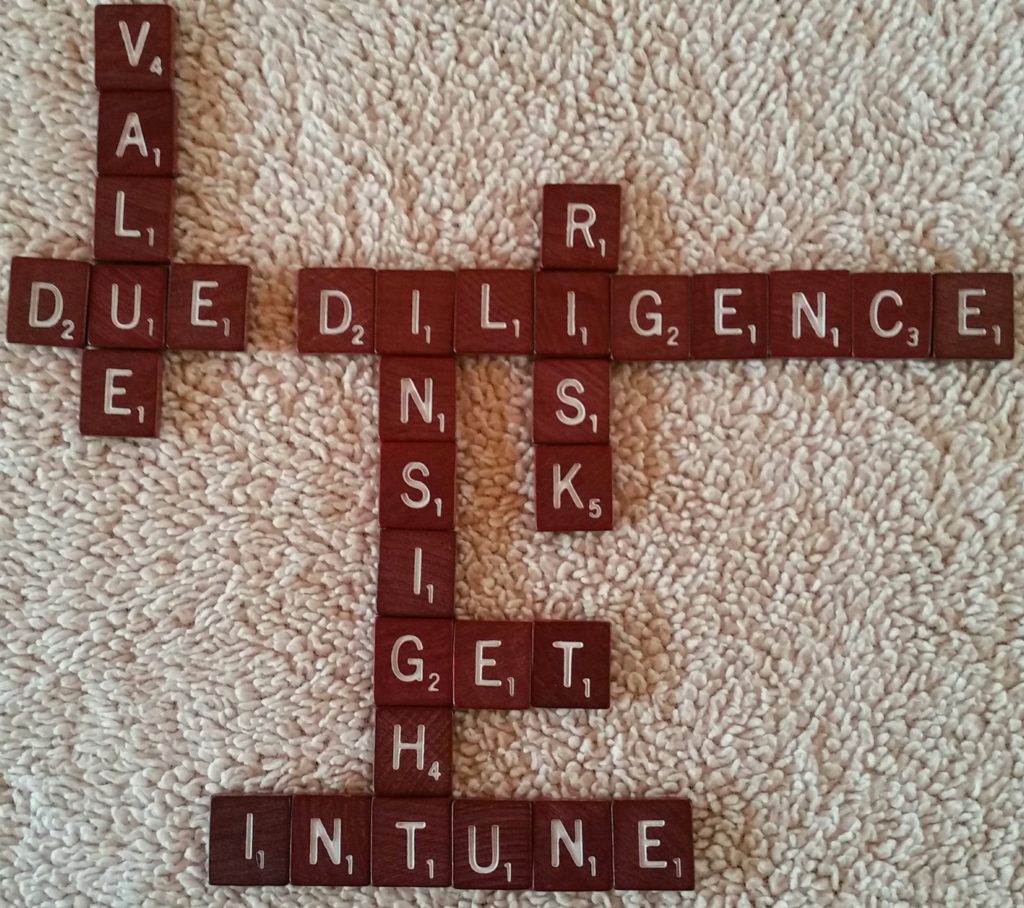

Get InTune with What You're Buying and How Much It Should Cost

For more than a decade, InTune Business Advisors LLC has helped clients discover, assess and capitalize on opportunities. Led by James A. Loeffler, a CPA, CFE, MBA and CSSBB with more than 25 years of experience, we offer a full range of acquisition services.

Corporate Development: Target Identification, Strategy, and Introduction

While there are many reasons for purchasing a company, the most prevalent is growth potential. But how do you want to grow? Are you looking for production capabilities, access to new markets, complementary products, intellectual property, or another advantage you don’t currently have? What is the size range of the ideal target? What about the location? After we work with you to build the ideal target profile, we’ll identify, research and prioritize the top candidates. We’ll discuss the pros and cons of each so you can decide which one to pursue. We also want to understand how fast you want to close and what terms you absolutely must have. These and other factors impact our research, approach and strategy.

Due Diligence: InTune's Four Distinct Advantages

As CPAs and former Big 4 auditors, we apply a considerable breadth and depth of knowledge to discover what you’re really buying. In addition, InTune Business Advisors brings four distinct advantages to due diligence. First, as Certified Fraud Examiners, we bring an additional layer of scrutiny of the target’s internal control structure and the resulting transactions flowing through it. This scrutiny extends to discretely evaluating customer and supplier relationships (e.g., related parties, comparisons of vendor and employee addresses, banking practices, etc.).

Second, we have considerable experience in data mining and analytics. This means more efficient due diligence because we can rapidly acquire and analyze datasets related to sales, inventory, purchases and other high-volume transactions underlying business performance. We provide insight into customer concentration, product mix, margin analysis, supplier pricing patterns, and other key metrics in a way that saves time and money. Because we have experience with a multitude of ERP software and various systems, we can quickly find the information we’re looking for and put it in the right format for analysis. This saves time and money.

Third, we are Certified Lean/Six Sigma Black Belts (process improvement experts), which gives us the unique ability to rapidly identify unforeseen synergies, opportunities, and issues that can impact the price and/or post-acquisition integration. For example, a food distributor had high volumes of returned merchandise on large orders, requiring credit memos to be issued to customers. This tied up working capital, caused extra work for the accounting department, and reduced customer satisfaction. Upon discussions with salespeople, warehouse personnel, and the IT department, we discovered that the company was not fully utilizing its system’s sales order review capabilities, which in tandem with certain process changes, would have solved the problem. The Post-Acquisition Integration Team saw this as an opportunity to immediately resolve a costly issue.

Fourth, the foregoing illustrates our ability to discretely perform due diligence under the guise of process improvement consultants. This is a significant advantage, because we can gather critical information from employees while maintaining the confidentiality of the deal. This results in true, on-the-ground insight from those on the front lines – insight that otherwise would not be available.

Valuation

Our valuation procedures and methodologies conform to the AICPA’s Statements on Standards for Valuation Services. The advantages we bring to due diligence are reflected in the quality of our business valuations. Further, our robust models can accommodate any type of business, with a strong focus on the drivers specific to that business and industry.

Value is in the eye of the beholder. What is the target worth to you and/or your existing business? What are your expectations for the performance of the combined entity? Can that performance be realistically achieved? Under what conditions? How will performance change under different conditions? To answer these questions, we create and evaluate different scenarios involving sales forecasts, pricing, costs, and other key variables that allow you to evaluate different levels of performance of the integrated entities. This results in prudent, measured projections that are consistent with firm-specific, industry, and economic trends, and that further consider unique accounting, tax, and legal issues. We want you to have every advantage when negotiating price and other terms of the deal.

Negotiations and Deal Structure

How the deal is structured will have tax consequences. Should you purchase the stock or the assets of the target? If the latter, what liabilities should you be willing to assume? How will you finance it? We have a broad network of trusted capital sources, which allows us to align the right deal financing to help ensure success.

Post-Acquisition Integration

In order to help ensure a smooth transition, our process improvement experts can help your team address post-acquisition items identified during due diligence. Our focus here is to align people, processes and systems so you can achieve your goals. Examples include curing internal control gaps, creating reports with better information, eliminating errors from core processes, and other value-added initiatives.

When it comes to achieving your growth objectives, you want to make sure the acquisition fits your long-term growth strategy. You want to know what you’re buying, and you don’t want to overpay. That’s why clients trust the acquisition process to InTune.

If you're contemplating an acquisition, let's talk.

We're equally comfortable leading the entire acquisition process, or simply functioning as part of a larger team.