According to the Association of Certified Fraud Examiners, the typical organization suffers fraud losses totaling about 5% of revenues. How much is fraud costing your company?

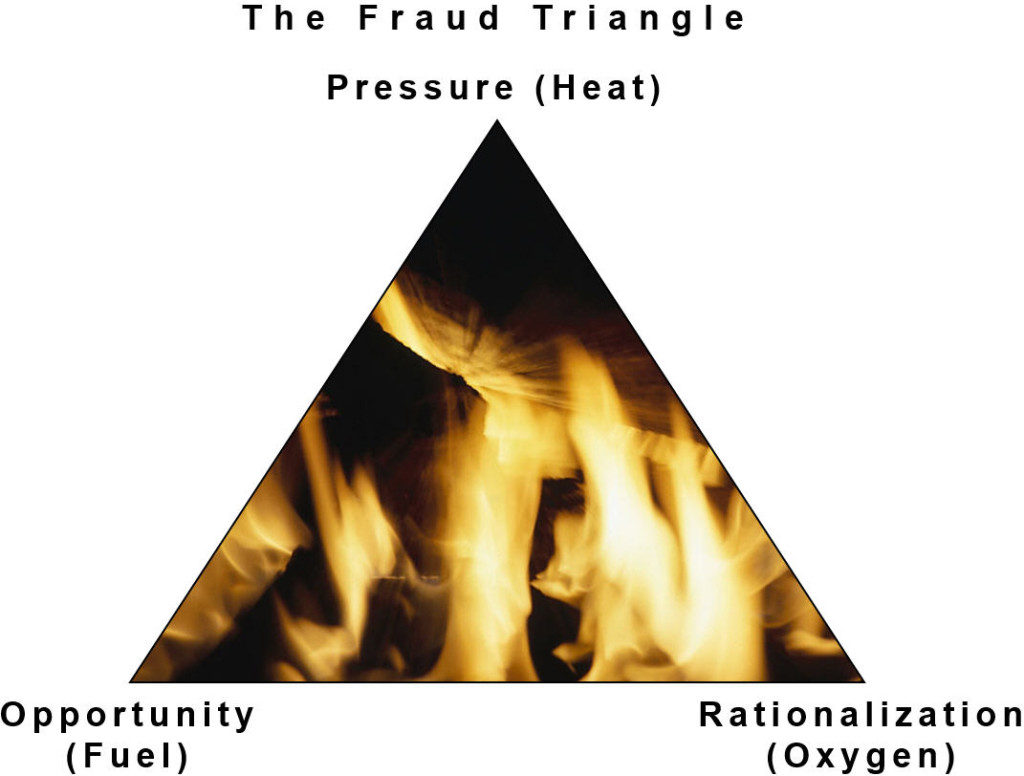

The fraud usually starts small, as otherwise honest employees, facing what they believe to be overwhelming pressure, exploit the opportunity to steal and embezzle. They rationalize their actions in many ways, such as, “I’ll pay it back as soon as I get ahead; after all, I work hard and I deserve it.” But as they get ahead, they get used to the lifestyle, and they keep spending. And the fraud gets bigger. And you lose more money.

About $150,000.

That's why we make fighting fraud our business so you can grow yours.

Led by James A. Loeffler, a CPA and CFE with more than 25 years of experience, our Certified Fraud Examiners have decades of experience and expertise in fraud prevention, detection, and investigation. Our services include:

Fraud risk assessments

Our risk assessments include fraud risk assessments. We consider multiple factors, including the industry in which your company operates, your culture (e.g., tone at the top, whether employees have a clear and safe way of reporting possible fraudulent activity, etc.), the countries in which your company operates, your organizational structure, and other factors.

Given this backdrop, we work with your risk managers and internal auditors to assess the inherent risk of various internal fraud schemes (e.g., skimming, purchasing and billing schemes, payroll schemes, etc.) in different areas of the organization. We then assess the controls in place to prevent or detect such schemes. Our goal is to identify and prioritize the gaps, based on the likelihood and impact of successful schemes.

Internal control reviews

Opportunities for fraud can pervade your internal control structure. This is particularly true in privately-help companies. While they continue to grow, their legacy systems, processes, policies and procedures, reporting, and other elements of the internal control structure may not have kept pace with how they currently do business.

Small businesses have an even greater challenge, since they have not yet grown to the point where they can develop, implement, and maintain all components and principles of a sound internal control framework.

Our CPAs and CFEs understand these dynamics, and specialize in curing internal control gaps - gaps that provide fraudsters with the opportunity to steal from your company.

Management Reporting Structures

Many businesses don't have the luxury of large enough staffs to ensure a proper segregation of duties in the accounting area. One or two people may wear many hats: The person who invoices customers may also be responsible for recording and depositing cash receipts; one employee may be responsible for processing vendor payments and setting up vendors in the accounting system. That is why you need to review the right information in the right format on a consistent basis in order to mitigate such fraud risks. We can design and create management reports from any accounting system – reports that you can generate and review on demand.

Fraud prevention programs and training

Our fraud prevention programs and training services are designed to help you reduce your potential loss, mitigate your corporate liability and enhance your business image. We will customize training and education programs for employees so that fraud prevention is truly an organization-wide effort. Our training considers your size, industry, corporate culture, and other characteristics. According to the ACFE, of those organizations who suffer occupational fraud, those with fraud prevention programs in place cut their losses in half. In addition, our fraud prevention and awareness training is readily applicable to cyber security training.

Fraud Investigation

If you suspect fraud, contact us. we will conduct a discrete, professional fraud investigation that will answer the who, what, when where and why of the matter. We’ll maintain a proper chain of custody as we gather evidence through interviews, documentation, auditing and data mining and analysis in order to reconstruct transactions and events. We will build the strongest possible case for restitution and prosecution, which will provide you with options as to how to proceed.

Fraud is a Serious Problem.

Fraud is a devastating problem. Contact us to see how you can prevent or minimize the impact of fraud on your organization.